Save Your Tax Dollars! Check Your Homestead Exemption TODAY

Homeowner Education Alyssa Ramirez October 12, 2023

Homeowner Education Alyssa Ramirez October 12, 2023

Owning a home is a milestone that comes with a myriad of responsibilities and financial considerations. Among these, applying for a homestead exemption is a crucial step that often gets overlooked. Austin residents, this one’s for you – understanding the significance of this exemption can significantly impact your financial landscape.

As of 2022, homeowners were allowed to apply for this exemption just after purchasing instead of waiting until the following year to apply. The benefits are worth the small effort to apply! As you know by now, we are committed to keeping you as educated and homeowner-savvy as possible.

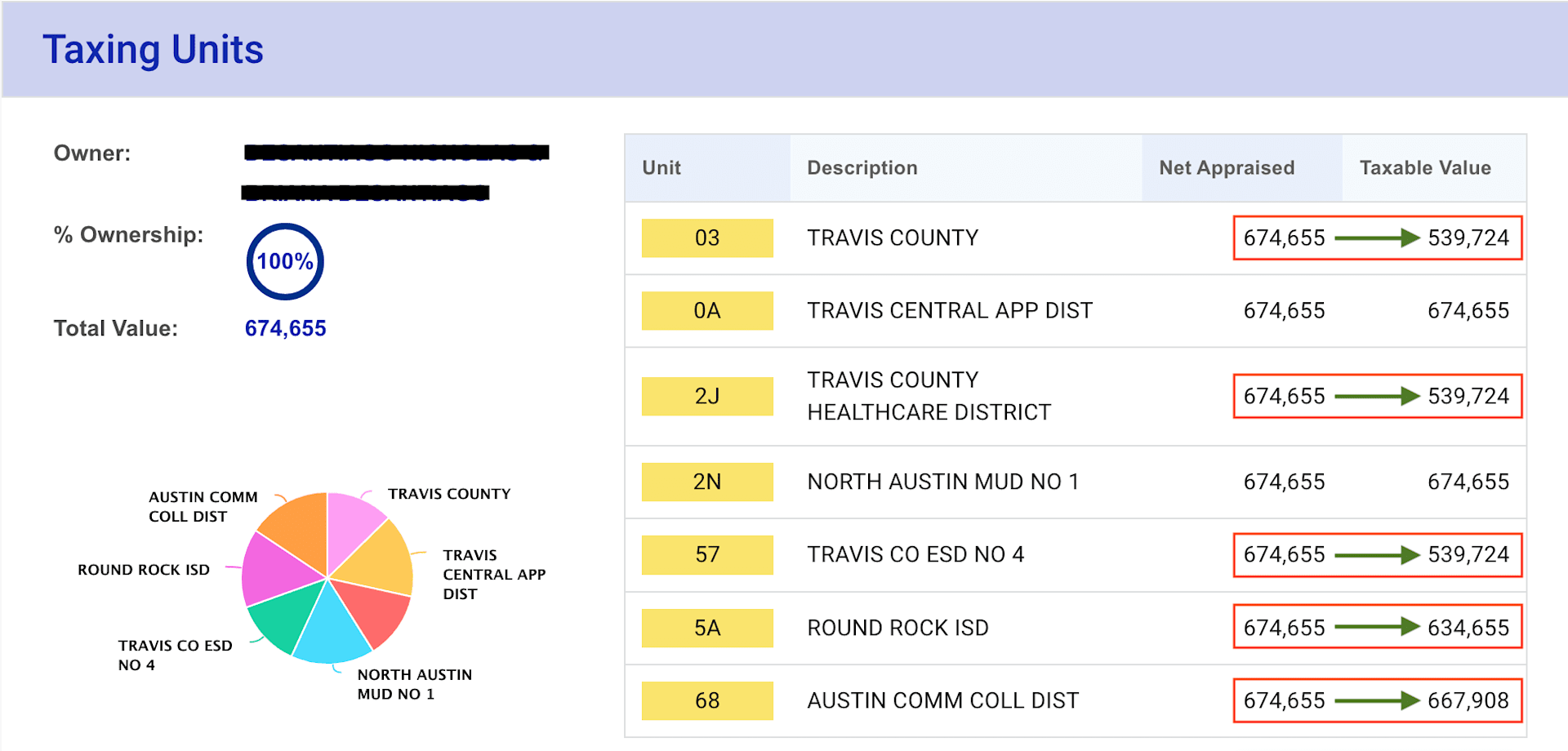

Now is a great time to check your property profile on the TCAD website to make sure your homestead exemption was processed for this year's tax savings because having this on your property can save you hundreds to thousands of dollars every year. If you don't see yours but you sent in your application, it may be a simple mistake on the county's part - but we are here to help you figure it out. Keep reading to follow the steps to confirming your exemption status and tax savings!

Every year we have a handful of clients who didn't or couldn't prioritize this from their purchase and they ended up overpaying by an average of $6,000+ (but luckily, we caught it so that they can work on getting a refund! If you aren't sure if your exemption was processed in time, we'd love to help you through confirming this so that you can get a refund from the tax office if possible.

Reminder of Your Homestead Exemption Benefits The main advantage is that after a full taxable year of your ownership, the taxable value cannot go up more than 10% from the previous year - meaning even if the market value goes up 20%, your taxable value can only go up 10% each year. So the longer you stay, the bigger the difference between the market and taxable values. This benefit doesn’t go into effect until after the first full year of ownership (if you purchased in 2022… it is technically applied for 2023, and the cap should be present for 2024 and beyond.

The exemption also lowers your property taxes by removing part of the value of your property from taxation - sometimes by about 20%+/-. (This amount depends on each county). This benefit is effective immediately in the year you apply, so could be immediate savings for you but would require you to hastily apply after purchase.

Follow the steps below to ensure your property tax savings can begin immediately:

We know this can all be very confusing! Set a meeting with us and we will walk you through this on the phone or by screen share!

Subscribe to Our YouTube Channel for More Homeowner Education

At The Ramirez Team, we understand the complexities of real estate, and we're here to simplify them for you. Don't miss out on the opportunity to make well-informed decisions and embark on a successful real estate journey. Join our community of educated homebuyers - together, let's unlock the doors to homeownership and build wealth through real estate. Our YouTube video series is dedicated to addressing common homeowner questions and offering practical, money-saving tips. Whether you're a first-time buyer or a seasoned homeowner, our videos cover a wide array of topics, including understanding property taxes, mortgage refinancing, home improvement ROI, and much more.

Subscribe today and unlock the keys to

successful home buying and wealth building through real estate!

Stay up to date on the latest real estate trends.

Homeowner Education

Be Prepared Before Notices Arrive in April or May

Homeowner Education

Empower Your Homeownership Journey with Expert Insights and Timely Advice

First Time Homebuyer FAQ

Don't forget to consider these factors before starting your home purchase journey.

Homeowner Education

Save more money by applying for your homestead exemption NOW

The Empowered Homebuyer's Guide

Looking to buy a home in Austin? Discover crucial mortgage advice to avoid pitfalls and secure your dream home.

Homeowner Education

If you own and reside in a home in Texas, you may be eligible for a tax break on your property value. Read more to see if you qualify and learn how to apply.

With The Ramirez Team, you can expect great attention and care that extends beyond each transaction. Being a lifetime resource for all things real estate and Austin is their #1 goal. What matters to them most is providing support and service to those looking for a personalized real estate experience. They live by the motto: Success is measured by how you make others feel.